Be part of our community

JOIN LIBF FOR ACCESS TO FINANCIAL WORLD

Financial World Archive

Access the FW archive here

Follow us

Data protection

© The London Institute of Banking & Finance 2024 - All rights reserved

Introduction: fintech

The future of fintech in your hand

Ouida Taaffe introduces the February issue, which focuses on fintech. There are articles on why fintechs haven’t displaced retail banks; what digital financial assistants might mean; how AI could impact on financial advice; and the power of the smartphone spy in your pocket, among others

When the dotcom boom began just over 25 years ago, it was trumpeted as a radical economic shift that would have a bigger impact on the world than the printing press. In some respects, its promise of shaking up whole sectors has been met – for both good and ill. The music industry, publishing and the high street have all been reshaped, largely because they lost their gatekeeping power.

The UK’s incumbent retail banks, however, retain their position as the primary providers of current accounts, mortgages and credit. Fintech banks have largely failed to dent their market position, even as bank branch usage has plummeted. According to research company YouGov, around 37% of people in the UK ‘hardly ever’ use a bank branch and only 7% are regular users.

But GenAI promises to be highly disruptive, in unexpected ways, so this issue of Financial World takes a fresh look at what’s happening in fintech and what might be coming.

There are, arguably, three main reasons why incumbent banks still dominate the UK retail market. First, services that banks provide rely on capital, which can’t be spun up in someone’s back bedroom for free, nor manufactured in low-cost economies. Second, consumers see little value in switching away from banks that provide ‘free-if-in-credit’ accounts. Third, regulation demands that banking services be safe and fair, which is expensive and demanding.

Fintech has disrupted some aspects of financial services where technology could add clear efficiencies. For example, as Natasha de Terán points out in ‘Giant tasks for the giant killers’, former tech start-ups are now important players in retail payments. Square, Adyen and Stripe have become major companies. The underlying card payment networks, however, remain in place.

Now, though, more profound fintech innovation may be getting closer to retail financial services in the shape of agentic AI, as David Birch argues. Agentic AI carries out tasks across the web without human input and 2025 is, according to OpenAI Chief Executive Sam Altman, the year when “agents will work”. As a demonstration of what is already possible, OpenAI had a voice assistant order strawberries over the phone on its own.

That might not sound very exciting, but agentic AI will be able to do far more than the shopping. Google is working on a ‘universal assistant’ that can “understand and reason across information in your browser screen, including… text, code, images and forms, and then uses that information via an experimental Chrome extension to complete tasks for you”, including financial ones. Agentic AI could become a digital financial assistant that manages and optimises how we use money. The article ‘Opening sesame’ looks at what is possible, at what banks are doing and at what may be hype.

Banks have a lot of valuable financial data that other companies don’t possess, but the amount of ‘alternative data’ – particularly that collected by smartphones – is vast and very useful in AI models. Adriana Hamacher’s article, ‘The spy in your pocket’, explores some of the issues.

Agentic AI will be able to do far more than the shopping. It could become a digital assistant that manages and optimises how we use money

People use smartphones because they are so efficient. That’s also why GenAI is popular. It feels almost magical to get an instant, apparently free response. What, though, will the advent of GenAI mean for financial advice? Many people look for financial ‘tips and tricks’ online, particularly if they feel regulated financial advice is too expensive. People also get misinformed and scammed. In ‘Can AI close the advice gap’, we ask what GenAI holds for the future of financial advice provision.

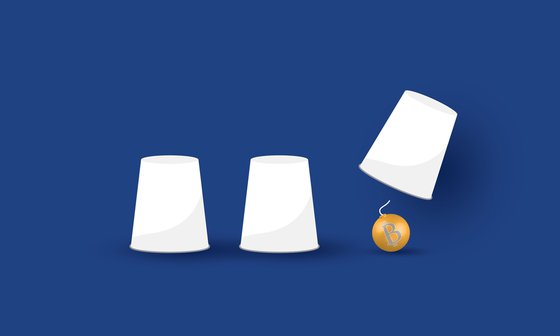

Governments are keeping a weather eye on developments in fintech, particularly payments. One of their primary concerns is maintaining the ‘singleness of money’ – that is, ensuring that the different forms of money in a jurisdiction, such as coins and funds in bank accounts, are exchangeable at par. That way, central banks retain control of rate setting and monetary policy. The incoming Trump government in the US is pro-crypto. The article ‘Will crypto trump the CBDC?’ examines what making bitcoin legal tender would really mean.

Though governments are wary of what some innovation might bring, they are not anti-innovation. In the UK there are plans to use tech to try to help solve a number of problems. Pisces – the Private Intermittent Securities & Capital Exchange System – is, for example, an IT project designed to boost liquidity on the London Stock Exchange. Richard Northedge explains what is planned and why in his article ‘Pisces: fishing in a shrinking pond’.

Governments help decide the course of the economy but should they decide who buys which company? The proposed takeover of Germany’s Commerzbank by the Italian bank UniCredit is generating a lot of political heat in Berlin. Hanno Mußler, the banking correspondent at the Frankfurter Allgemeine Zeitung, explains why there is such heated debate over the way in which Unicredit has ‘crept up’ on Commerzbank and what is likely to happen next.

The UK government has said that it is going to take an ‘unashamedly’ pro-growth approach. “We will work with regulators to get rid of rules that needlessly hold back growth,” a spokesperson for the Prime Minister said. What that will mean for financial services will play out over time but, in principle, it does not mean laxer standards. As Sarah Butcher examines in ‘Getting fit and proper’, the bar for ‘fitness and propriety’ is being raised for both individuals and firms in the Financial Conduct Authority’s updated policy on non-financial misconduct.

Regulations always provide work for lawyers and differences of legal opinion can end up in the courts. In her regular column on legal issues, barrister Deborah Sabalot looks at the claims and counterclaims on the payment of motor finance fees and explains why regulatory rules can sometimes fall foul of the law.

There are, of course, regulatory regimes that are an unshakeable challenge to even the largest companies. Europe’s new rules on Corporate Sustainability Reporting fall into that category. In their article ‘A powerful compass for business’, Marie Chevalley and Emmanuel Rondeau argue that meeting the CSRD’s requirements on ‘double materiality’ disclosures will not be a burden but rather a boost to good business analysis.

Vital though analysis is, it doesn’t necessarily provide easy answers. One problem in the UK economy that touches every part of it – savings, pensions, later-life planning, investment, discretionary spending, productivity, earnings and growth – is the eyewatering cost of housing. In ‘The house that Jack didn’t build’, Paul Wallace looks at whether the UK government can meet its pledge to ease the housing crisis by building hundreds of thousands of new homes.

The government would like house prices to fall relative to income. In ‘Losing at home games’, Frances Coppola asks whether the government should, or could, try to reduce house prices to help young people buy their own homes.

What happens in UK financial services has long had global importance. Fintech has not changed that and may hold new potential. In ‘Setting a new course in payments’, Tim Green asks whether UK fintech RTGS.global can shake up cross-border payments with ‘atomic settlement’.

Cross-border payments are also on the minds of incumbent banks and regulators. Joy Macknight in ‘Project Agora’s big plans’ explains the multibank initiative that aims to demonstrate the potential value of BIS’s ‘unified ledger’ model for transaction banking.

Our columns in this issue of the magazine are by Dr Thorsten Fröhlich, who explains why and how Syntea, the AI learning buddy, is enhancing student engagement at LIBF; by Prof Julian Le Grand of the LSE, who looks at the productivity of mutuals and calls for policy change to support them; by Dr Carl Wright who argues that sustainable action at the community level is the future of tackling climate change; and by Stuart Mackintosh, the Executive Director of the G30, who examines the ESG scorecard of Bidenomics.

We have four book reviews. Mindmasters, by Sandra Matz, is a book that sets out to explain “how computers can translate seemingly mundane and innocuous information about what we do into highly intimate insights about who we are and ultimately prescriptions of what we should do”. The review by Martina Garcia gives a nice potted overview of some of the things we should all be thinking about.David Birch’s review of MoneyGPT: AI and the Threat to the Global Economy, by James Rickards, explains why he disagrees with some of its arguments. Alex Gray, in his review of World Without End, by Jean-Marc Jancovici and Christophe Blain, tells why this handsome graphic book on sustainability is “one to buy”. But Richard Northedge is less enamoured of Money: a Story of Humanity, by David McWilliams, and gives a lively outline of why that is.

Ouida Taaffe is the Editor of Financial World

More from

Fintech

Introduction

The future of fintech in your hand

Ouida Taaffe introduces the February issue, which focuses on fintech. There are articles on why fintechs haven’t displaced retail banks; what digital financial assistants might mean; how AI could impact on financial advice; and the power of the smartphone spy in your pocket, among others

Read Now

DIGITAL FINANCIAL ASSISTANTS

Opening sesame

Digital financial assistants are coming to a bank near you, but developing bots that know the right thing to say at the right time and can run all your financial affairs for you will be much harder than some suggest, reports Ouida Taaffe

Read Now

SMARTPHONES

The all-seeing spy in your pocket

What does your smartphone know about you and who does it tell? Adriana Hamacher delves into the data goldmine in your pocket and raises some concerns

Read Now

fINTECH V. THE INCUMBENTS

Giant tasks for the giant killers

Natasha de Terán explores whether fintechs are really disrupting financial services and taking on the banking incumbents or whether the problems they face are proving too challenging

Read Now

ISLAMIC FINANCE AND ESG

Finding a common ESG ground

Can Islamic fintechs help the financial sector hit the UN’s Sustainable Development Goals? There is growing optimism but the industry is divided, Justin Cash reports

Read Now

CRYPTO AND REGULATION

Will crypto trump the CBDC?

Does the re-election of Donald Trump mean a new dawn for cryptocurrencies and a fresh setback for the idea of a central bank digital currency? Christopher Alkan examines the evidence

Read Now