Be part of our community

JOIN LIBF FOR ACCESS TO FINANCIAL WORLD

Financial World Archive

Access the FW archive here

Follow us

Data protection

© The London Institute of Banking & Finance 2024 - All rights reserved

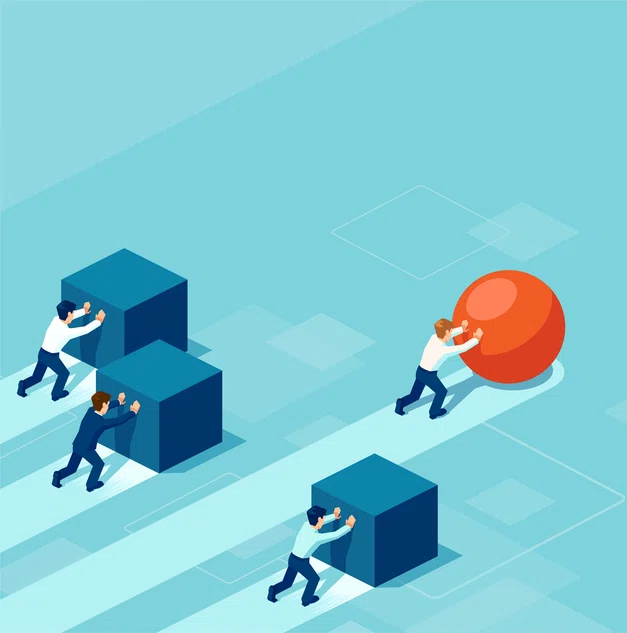

Fintech v the incumbents

Giant tasks for the giant killers

Natasha de Terán explores whether fintechs are really disrupting financial services and taking on the banking incumbents or if the problems they face are proving too challenging?

Fintechs have been dubbing themselves disruptors for the past decade, yet it’s hard to ignore the fact that the ‘disrupted’ industry incumbents are not just surviving but also enjoying healthy profit margins.

The last full-year figures had HSBC posting close to an 80% rise in pre-tax profits of £24bn, and Lloyds recorded a 57% increase in profits to £7.5bn. Of the big four UK banks, only Barclays bucked the trend with a 6% fall in profits to £6.6bn, but its comparatively lacklustre performance was down to a near £1bn in restructuring costs, not to any aggressive landgrab by fintechs.

“We say there is disruption going on in finance but the incumbents are more profitable than they have ever been,” says Jeremy Takle, co-Founder and Chief Executive of Pennyworth, a personal finance app. “In contrast, when Napster disrupted music, the industry lost billions.”

The UK banks, like many of their peers around the world, have benefited strongly from the rise in base rates and the ensuing growth in their net interest income. Data published by the Treasury Committee showed that NatWest, Barclays, Lloyds and Santander received more than £9bn in interest on Bank of England reserves in 2023 – a 135% increase on the previous year. Were fintechs providing the competition they boast of, it is arguable that base rate rises wouldn’t have automatically translated into such generous rises in incumbent bank profitability. Customer bases would have been challenged, savings rates would have faced upward pressure and loan rates downward pressure. There might have been profit increases, but not such large ones.

At the same time as the high-street incumbents have seemingly been awash with easy money, the fintech industry has been forced to tighten its belt. Innovate Finance reports that capital deployed into fintech has been falling globally year-on-year since 2022, with UK fintechs suffering a particularly precipitous fall, albeit from a high base. Global fintech investment fell 20% to $43bn in 2024 – down 68% from a peak of $136bn in 2021 – while UK fintech investment fell by 38% to $3.6bn in 2024 – down 72% from $13bn in 2021.

Fintechs less reliant on outside funding might be hurting less, but many continue to need to raise capital. How likely are they, in these straitened times, to move the needle on disruption? Can fintech upstarts really disrupt legacy consumer financial services and get consumers to switch, or is it their lot to build niche products and services and hope for a buyout?

The jury is still out. There have been some notable successes in fintech. James Codling, Managing Partner at the UK venture capital firm Volution, points to the payments plumbing area as one that has had some serious disruption. Here, the likes of Square, Adyen and Stripe have shaken up the merchant acquirer landscape, transformed business possibilities for merchants, helped power e-commerce and made payments a lot easier for consumers. In doing so, they have also helped cement the power of the card networks, increased our dependence on cards, facilitated the move to the non-cash movement of value and ensured that the banks’ all-important interchange income stream continues to flow nicely.

Neo banks went into the wrong part of the market with the wrong product. Most of them are only just starting to break even

Thanks to the growing use of digitised payments that these fintech giants have facilitated, consumers and businesses have reduced their reliance on cash and incumbent banks have also been able to close branches and reduce costs and overheads – an example perhaps of how disruption in one area has helped reinforce the position of incumbents in another. And, as Codling admits, the benefits haven’t been the universal democratising tool that fintech first promised. Merchants continue to face delayed payouts and hefty charges – charges that are now baked into pricing and are arguably inflationary.

Takle, who spent a few decades in banking at Barclays before dipping his toe in the fintech waters – first at Klarna, now at Pennyworth – sees many fintechs skirting around the banks and picking off bits and pieces of business that the incumbents aren’t interested in, such as non-standard lending. A curious strategy, perhaps, given that most of the money in retail banks is from consumer credit and savings. Takle believes this is because of not understanding how the banking profit model works and why.

“I would not underestimate how few people understand how money in banking is made,” he says. While acknowledging that the buy now, pay later model spearheaded by Klarna is a real disruptor that is seriously eating into some banks’ bottom lines, he points to how the neo banks “went into the wrong part of the market with the wrong product”.

Even for those armed with tech understanding and banking business model expertise, the going is hard

“Most of them are only now just starting to break even – and really only at the margin. The monetisation opportunities they have targeted, such as young customers’ current accounts, are slim at best. It’s very expensive to run current accounts, especially those with thin income and when no salary is paid into the account. Running current accounts is a costly exercise if you can’t deepen the relationship.”

Takle believes it is the crucial mix of banking knowledge and tech expertise that has been generally lacking in the fintech domain. “There are not many people that have come at fintech with both a tech understanding of what you can build and a domain expertise in banking,” he says.

He also argues that many of those who have come from a banking background have had experience in maintenance rather than building, and because of the siloed nature of banking, their experience even within that will tend to have been quite limited. “So, the transition is difficult and risky – and experience doesn’t often translate into usefulness in a start-up environment. That is why the Napster-like disruption hasn’t happened.”

Regulation is another potent aspect of why banking is hard to disrupt. Incumbent banks can offer free-if-in-credit current accounts for a few reasons:

- First, because they have economies of scale, attract deposits, make loans and sell other products that together cover the hefty costs of complying with financial regulations and building secure IT systems.

- Second, they have consumer trust and a sticky, older, more affluent client base that uses them for their primary banking services.

- Third, consumers are lazy. For the most part, the free-if-in-credit current account is actually a misnomer – consumers are not being paid interest on their balances, the banks are earning it. Where consumers do transfer their savings to deposit accounts, most use their current account provider, according to the Financial Conduct Authority’s (FCA) 2022 Financial Lives Survey.

So, even for those armed with tech understanding and banking business model expertise, the going is hard. “Banks are exploiting the customer inertia. Incumbents benefit from stickiness, presence and brand recognition,” Takle says, pointing to how banks are more profitable in consumer banking than they have been for a long time, thanks to “busy people with higher balances parked in savings accounts”.

It is precisely this highly coveted, but as yet scarcely contested, group of the so-called ‘mass affluent’ that Pennyworth is after. Takle says that while the top 1% customers are well served, the mass affluent are underserved. “These more profitable customers – which account for 60-70% of bank balances in the UK and therefore generate most of the revenue for banks – don’t tend to get a better service,” he adds. “That is the real opportunity – to service these customers better and win away their balances. They can do better than premium bonds and NS&I savings. At best, they get the number of a relationship manager and a gold card. This is the segment we are targeting.”

Now that all generations are using digital across the board, Takle believes the opportunity is ripe. Even so, given the strategic moat that the incumbent banks have, he admits it will be an uphill struggle to help customers out of their inertia.

“Inertia is a challenge. To break the inertia and really shift behaviours you need to be trusted and to add much more value. Helping busy people to effortlessly move their money into better savings, investments and extending low-cost credit without a balance sheet is tricky. You really need to be a bank.”

Pennyworth’s original business model was based on being a regulated entity that holds capital, using algorithms and artificial intelligence (AI) alongside a human element to solve the advice gap these savers face. In pursuit of this, Pennyworth duly obtained a banking licence, but even with that – and armed with claims of being able to run on 20% of the big banks’ cost bases – it has struggled to attract capital. Its

timing was off.

“Banking rightly requires capital and timing was unfortunate for us,” says Takle. “Following the fall of Silicon Valley Bank, and just as we got to UK authorisation, the availability of start-up bank capital disappeared.”

Pennyworth’s new direction, therefore, is to build on its AI-powered wealthtech and work with strategic partners – existing banks and wealth managers who are interested in the same target market.

One of Volution’s investments, Flagstone, has similar ambitions. Founded in 2013, as a platform for high-net-worth investors to help them manage and diversify their cash holdings, Flagstone now claims to be the UK’s leading savings platform. Targeting all sorts of savers and partnering with the likes of Revolut and Saga, it runs an online platform that gives savers access to hundreds of deposit accounts through a single application, enabling them to switch at ease between accounts. The advent of agentic AI (as discussed by David Birch in his article in this issue) promises to turbo-power this approach.

That raises the prospect of disruptors such as Flagstone being disrupted themselves by better AI agents. It could also be argued that, if successful in its ambitions, Flagstone won’t so much disrupt the deposit market as reinforce it. Similarly, by partnering with incumbents, both they and Pennyworth stand to strengthen the incumbents’ positions, not weaken them. But one thing they both may do is encourage switching. Helping wealthier, older consumers to abandon their inertia – now that really would be disruption.

Natasha de Terán started her career in the financial markets as a practitioner before becoming a journalist and later taking up communications, policy and regulatory roles. She has worked across Europe and led public policy, regulatory affairs and communications functions internationally

More from

Fintech

Introduction

The future of fintech in your hand

Ouida Taaffe introduces the February issue, which focuses on fintech. There are articles on why fintechs haven’t displaced retail banks; what digital financial assistants might mean; how AI could impact on financial advice; and the power of the smartphone spy in your pocket, among others

Read Now

DIGITAL FINANCIAL ASSISTANTS

Opening sesame

Digital financial assistants are coming to a bank near you, but developing bots that know the right thing to say at the right time and can run all your financial affairs for you will be much harder than some suggest, reports Ouida Taaffe

Read Now

SMARTPHONES

The all-seeing spy in your pocket

What does your smartphone know about you and who does it tell? Adriana Hamacher delves into the data goldmine in your pocket and raises some concerns

Read Now

FINTECH V. THE INCUMBENTS

Giant tasks for the giant killers

Natasha de Terán explores whether fintechs are really disrupting financial services and taking on the banking incumbents or whether the problems they face are proving too challenging

Read Now

ISLAMIC FINANCE AND ESG

Finding a common ESG ground

Can Islamic fintechs help the financial sector hit the UN’s Sustainable Development Goals? There is growing optimism but the industry is divided, Justin Cash reports

Read Now

CRYPTO AND REGULATION

Will crypto trump the CBDC?

Does the re-election of Donald Trump mean a new dawn for cryptocurrencies and a fresh setback for the idea of a central bank digital currency? Christopher Alkan examines the evidence

Read Now